Ytd federal withholding calculator

Federal taxes were withheld as if I worked 80 hours in one week almost 40. Exemption from Withholding.

What Does Ytd On A Paycheck Mean Quora

1547 would also be your average tax.

. 8899 E 56th Street. The tax calculator asks how much federal taxes am I paying ytd. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck.

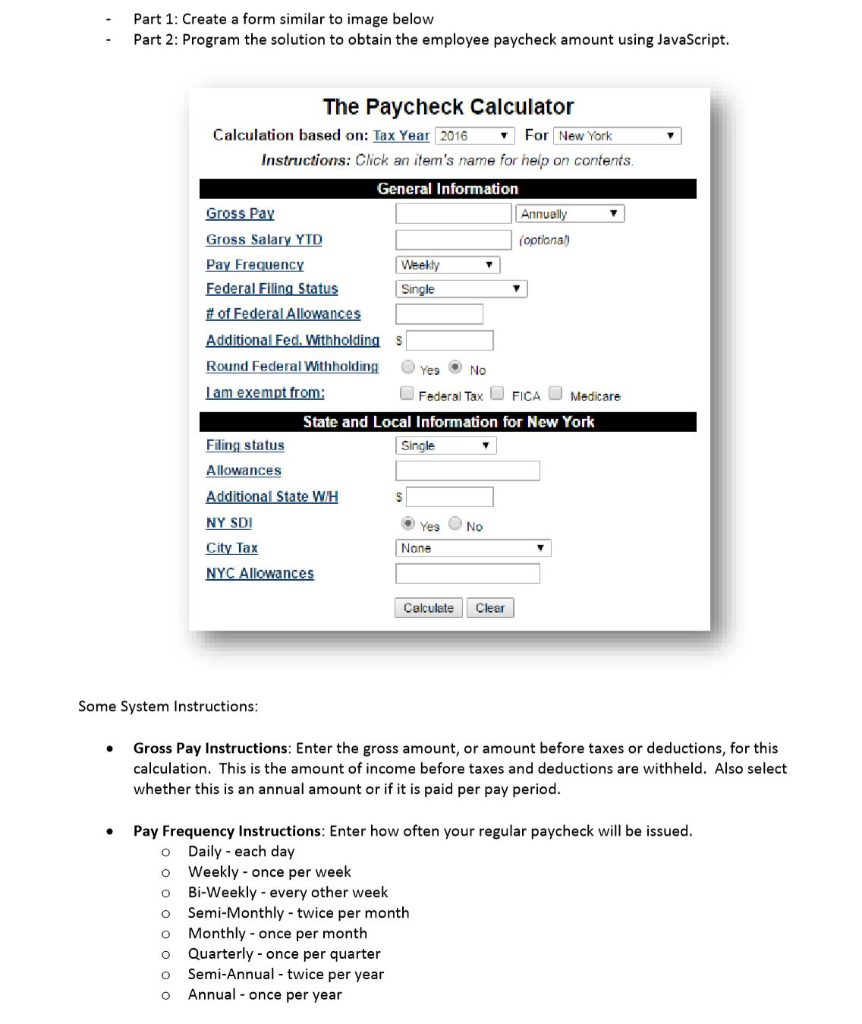

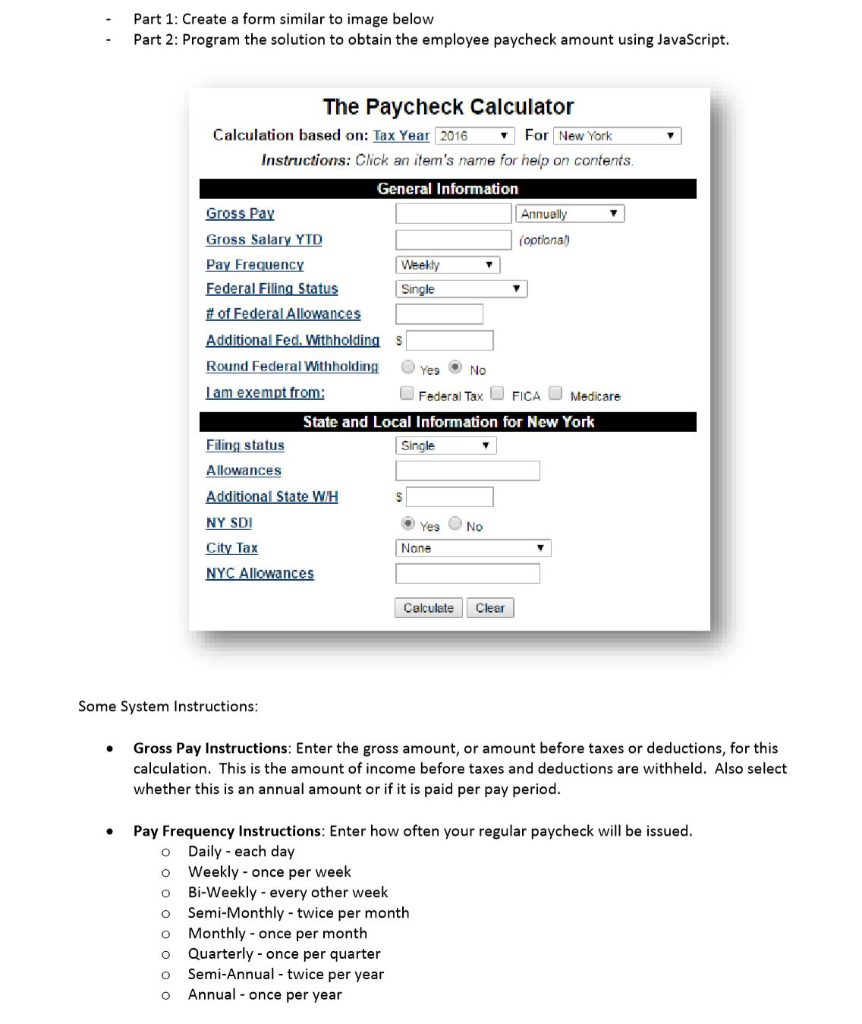

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. For employees withholding is the amount of federal income tax withheld from your paycheck. This online calculator is excellent for pre-qualifying for a mortgage.

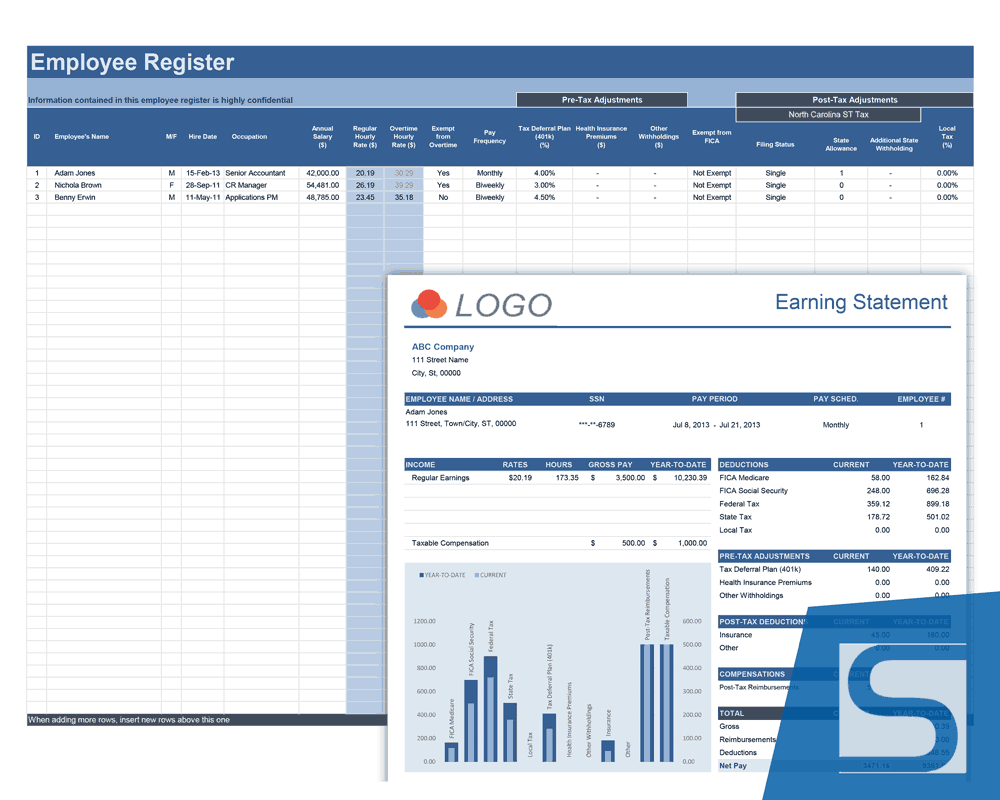

Computes federal and state tax withholding for paychecks Flexible hourly monthly or annual pay rates bonus or other earning items 401k 125 plan county or other special deductions Public. 10 12 22 24 32 35 and 37. A paycheck calculator allows you to quickly and accurately calculate take-home pay.

Defense Finance and Accounting Service. Send IRS W-4 Form for Retirees to. The amount of income tax your employer withholds from your regular pay.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Its a simple four-step process. See the IRS FAQ on Form W-4 to answer your questions about the changes.

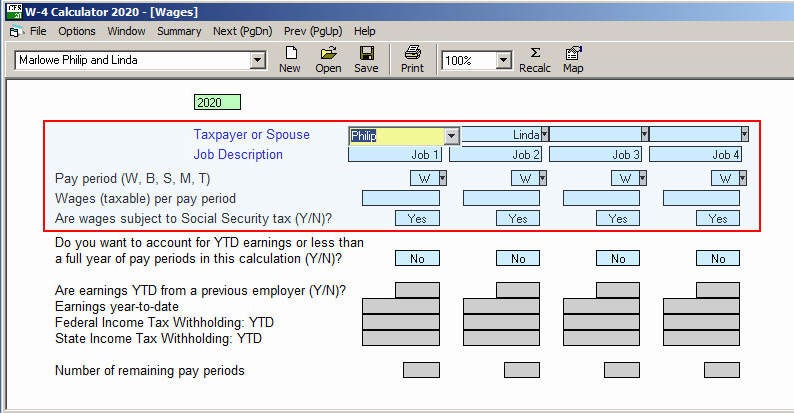

Determine your taxable income by deducting pre-tax contributions Withhold. Or mail or fax your signed completed forms. 2020 brought major changes to federal withholding calculations and Form W-4.

Enter the year-to-date income in the YTD box then choose the start and finish. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. The tax calculator asks how much federal taxes am I paying ytd.

You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate. A paystub generator with YTD calculator Enter Company Details like Name EIN Address and Logo Enter Employee Details like Name Wages and W-4 information Enter. Simple Paycheck Calculator General Information Total Earning Salary State Pay Cycle Marital status Number of Qualifying Children under Age 17 Number of Allowances State W4 Pre-tax.

How to Check Your Withholding Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay. 2020 brought major changes to federal withholding calculations and Form W-4.

This online calculator is excellent for pre-qualifying for a mortgage. IRS tax withholding calculator question. The procedure is straightforward.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Federal taxes were withheld as if I worked 80 hours in one week almost 40.

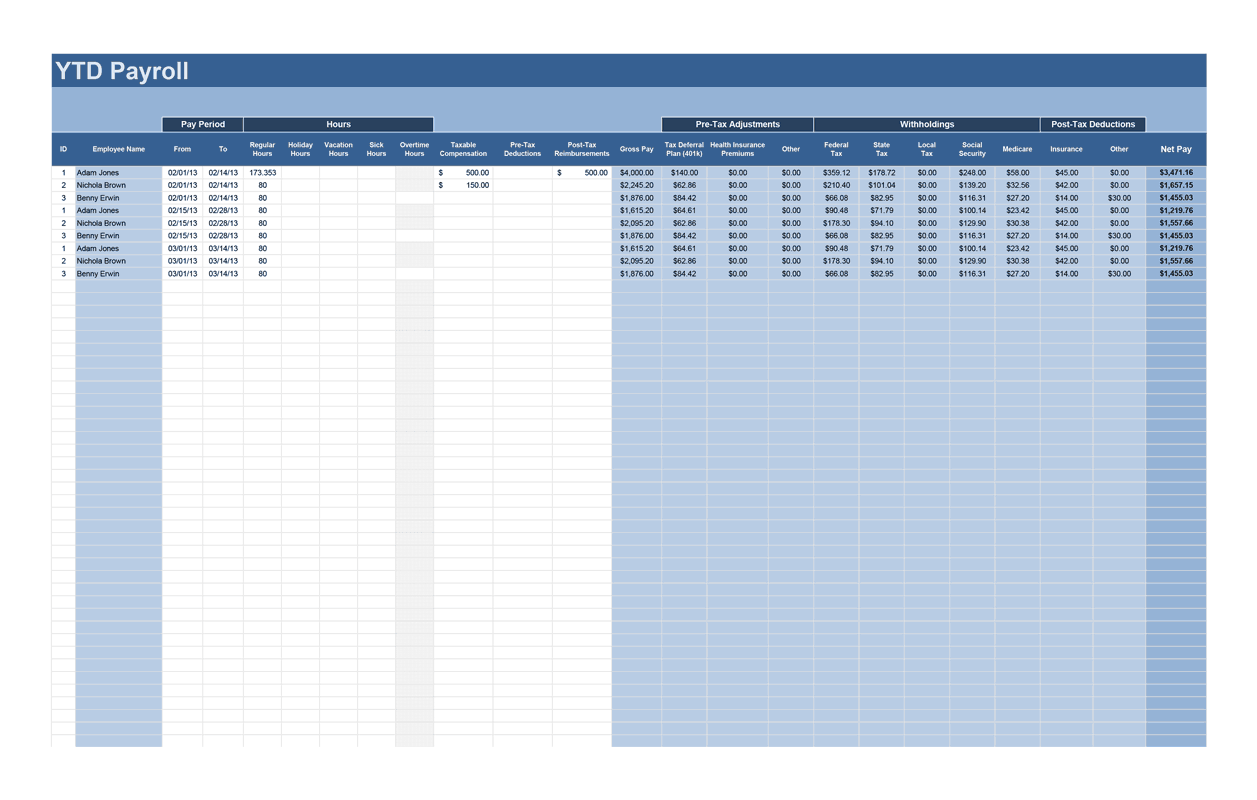

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Payroll Taxes Methods Examples More

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

Filing Status Instructions Select Your Filing Chegg Com

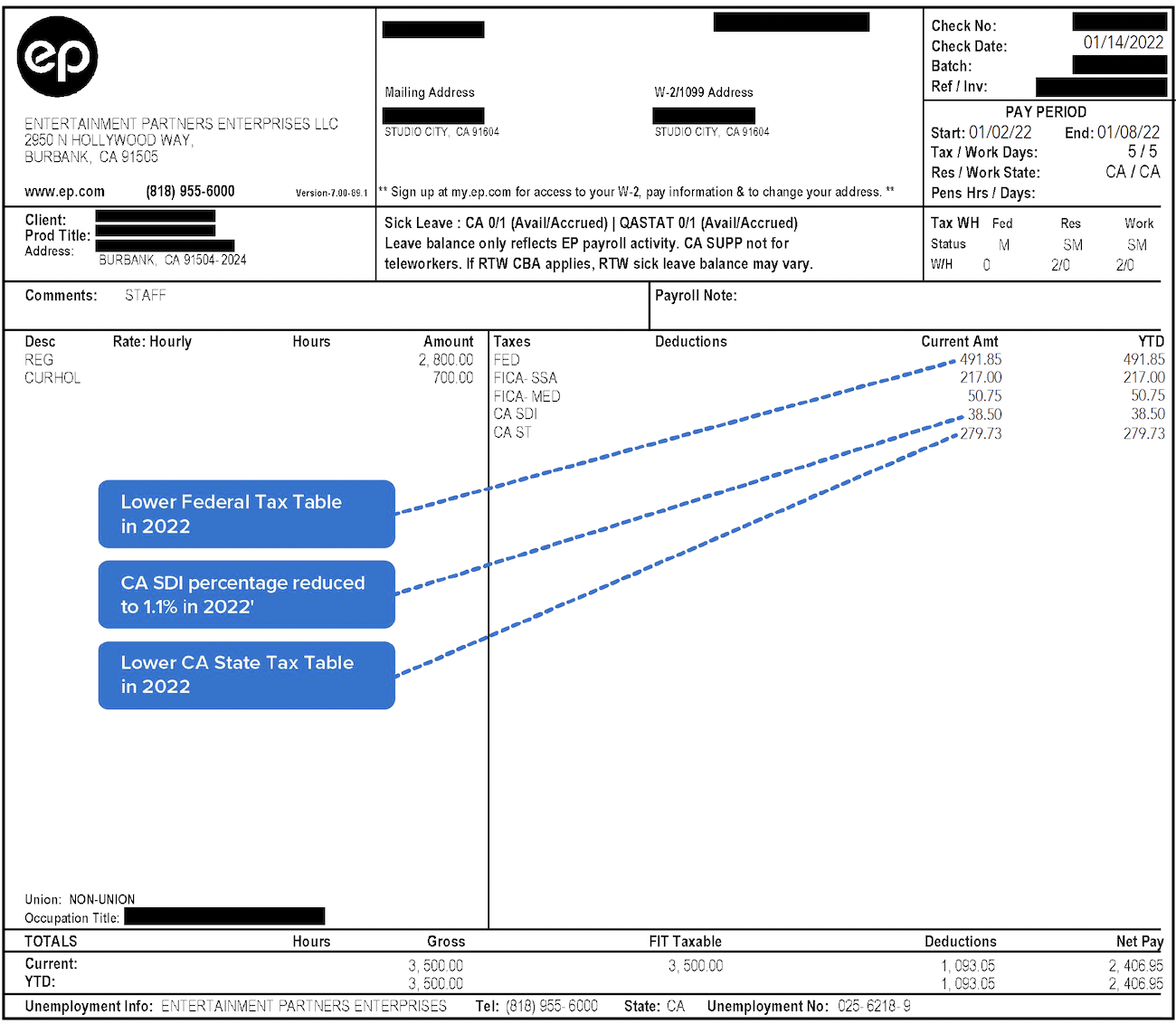

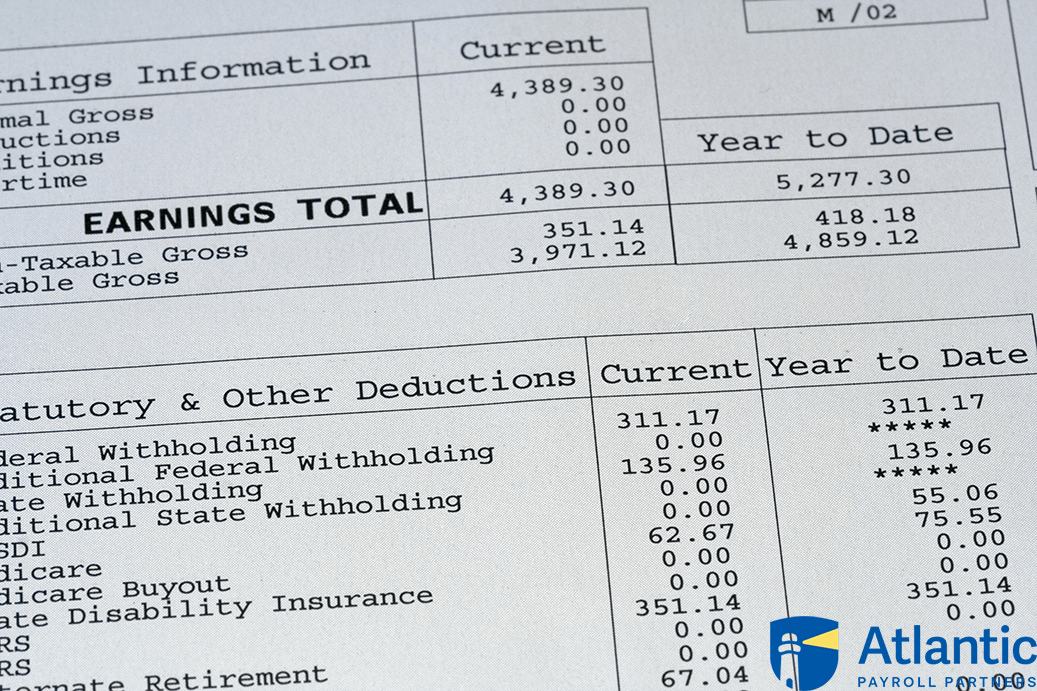

Decoding Your Paystub In 2022 Entertainment Partners

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

How Do You Get Info Back On Pay Stubs Withholding Status And Allowances Extras No Longer Show On Paystub

Payroll Calculator Free Employee Payroll Template For Excel

W 4 Calculator Cfs Tax Software Inc

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Net Pay Atlantic Payroll Partners

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hrpaych Yeartodate Payroll Services Washington State University

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube

Payroll Taxes Aren T Being Calculated Using Ira Deduction

Us Enter Year To Date Ytd And Current Amounts Wagepoint